Health Savings Accounts (HSAs) are the undeniable top choice for paying for current medical expenses or saving for future healthcare costs. But they don’t stop there…

HSAs are the most tax-advantaged savings account available.

Medical expenses are one of the facts of life. Regardless of your age, current health, lifestyle or tax bracket, you will inevitably at some point incur healthcare costs. Knowing that you’ll be spending on these expenses eventually, it makes sense to save the most possible tax on those expenses by putting savings into an account designed specifically for healthcare expenses.

Not beginning contributions to your HSA as soon as possible means time and money lost from the tax deduction and tax-free lifetime earnings. Did you know that you can only contribute to your HSA until age 65, before your Medicare benefits begin?

The Increasing Cost of Healthcare

A 65 year old couple retiring this year should expect to spend $300,000 on healthcare during their lifetime. Retirees typically have a fixed income, so it makes sense to fund your Longevity bucket well and take advantage of tax savings opportunities where possible. HSAs are a solution.

HSAs must be paired with a qualified consumer-driven health plan (CDHP), which typically has higher deductibles than other health insurance plans. (Higher deductibles are offset by the lower monthly premiums that CDHPs often have.)

The Best Way to Save for Retirement

Always take advantage of any matching your employer offers on your HSA and 401(k) contributions- it’s free money.

If you can max out your HSA contributions with payroll withholding, do so. HSA contribution limits for 2024 are $4,150 for individuals with self-only insurance coverage and $8,300 for individuals with family insurance coverage. Additionally, once you are over age 55 you can contribute an extra $1,000 to your HSA annually as long as you are already eligible to make HSA contributions.

It’s important to note that you may only contribute to your HSA until you reach age 65 and before your Medicare benefits begin. Not participating in a HSA while you are eligible is time and money lost from the tax deduction and the tax-free lifetime earnings to which it is privileged.

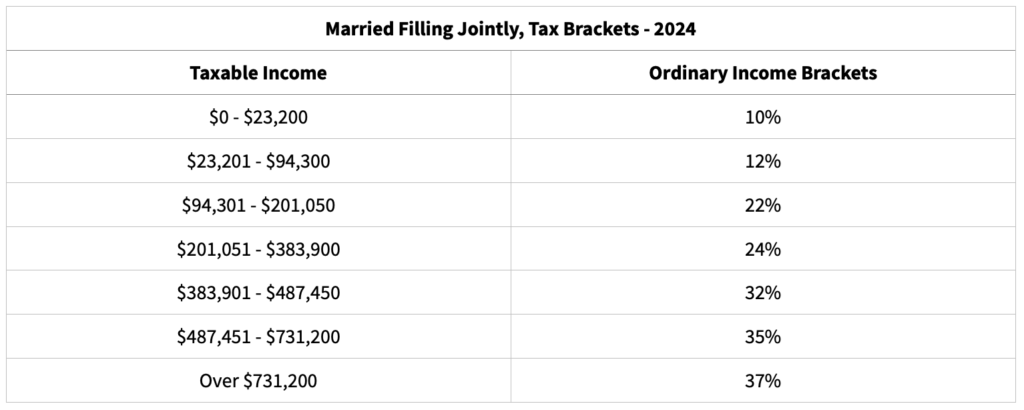

HSA & Taxes

HSA contributions are a tax deduction at the federal level (though they are taxed at the state level in California). Those FICA tax savings are like an extra 7.65% for you (and your employer, if they are matching you!). One of the biggest perks of an HSA is its triple tax benefit– contributions are tax free, withdrawals are tax-free, and interest grows tax-free — making it the most tax-advantaged savings account on the market.

Withdrawals from your HSA are tax-free when used for a qualified medical expense. Any withdrawals for non-qualified expenses face applicable income taxes and an additional 20% penalty. But, that 20% penalty goes away after you turn 65, so non-medical withdrawals after 65 are treated exactly the same as withdrawals from a traditional 401(k) or IRA.

Health Savings Accounts are a great way to save for your retirement longevity needs. Our next best bit of guidance on the topic though: Do everything you can to stay in good health now. Invest in yourself for now and the future by taking part in the best healthy lifestyle that works for you.

Life By Design Investment Advisory Services is a HealthSavings Advisor. LBDIAS can help you identify the best retirement solutions for your specific needs and put them into action. Contact the team today to set up your next appointment and proactively prepare for your retirement.

Life By Design Investment Advisory Services is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein.